ALAI Network's Dividend System: How Dividends Are Calculated and Distributed

The ALAI Network's dividend system is designed to reward token holders with consistent monthly payouts, providing participants with the opportunity for passive income. This post will explain how the system works, how much has already been paid out over the past six months, and the mechanisms behind its operation.

Total Dividends Paid

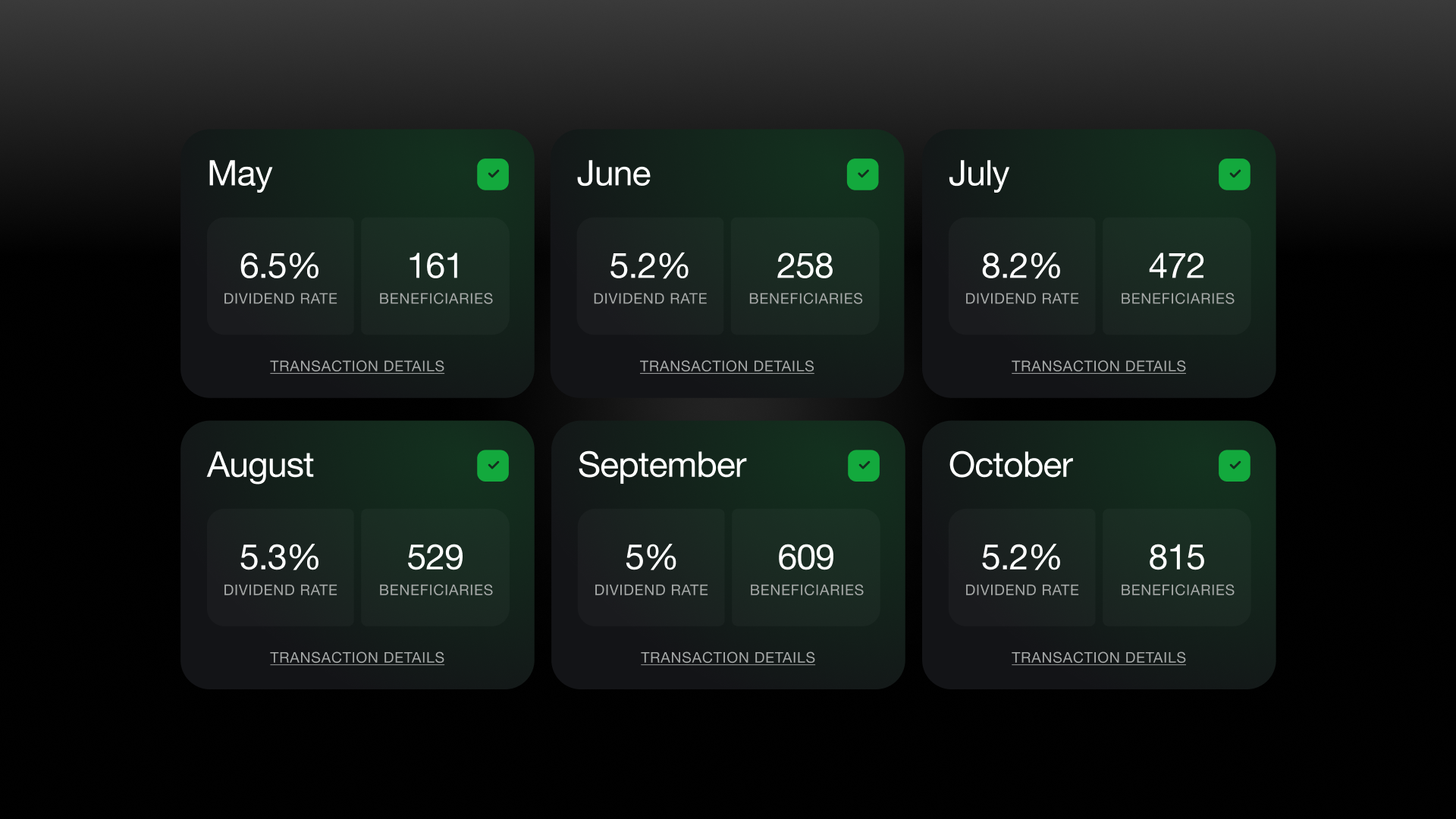

Over the last six months, ALAI Network has consistently distributed dividends to token holders. The payouts depend on the profits generated each month by the AI system, with the following actual monthly payouts as a percentage of AI-generated profits:

-

May: 6.5%

-

June: 5.2%

-

July: 8.2%

-

August: 5.3%

-

September: 5.0%

-

October: 5.2%

The average dividend payout over this period is approximately 5.9%.

How Dividends Are Calculated and Distributed

AI Manages Assets

When tokens are purchased, the funds are added to a trading pool managed by the AI system. Over the course of each month, the AI manages these assets, generating profits based on market analysis and trading strategies.

Profit Distribution

After the trading period ends, 50% of the profit generated by the AI is distributed to participants as dividends. The payout amount depends on each participant's share of ALAI tokens held. Dividends are paid out in USDT, providing stable returns that aren’t affected by the token’s volatility.

Conditions for Receiving Dividends

To receive monthly payouts, holders must retain ALAI tokens in their wallets for a minimum of 30 calendar days. This structure incentivizes long-term holding, reducing selling pressure and contributing to token price stability.

Conclusion

The ALAI Network's dividend system is a sustainable mechanism that supports project stability and provides token holders with passive income. The AI system generates profit within the trading pool and distributes it among participants, creating attractive conditions for long-term token ownership.