ALAI Network Updated Strategy

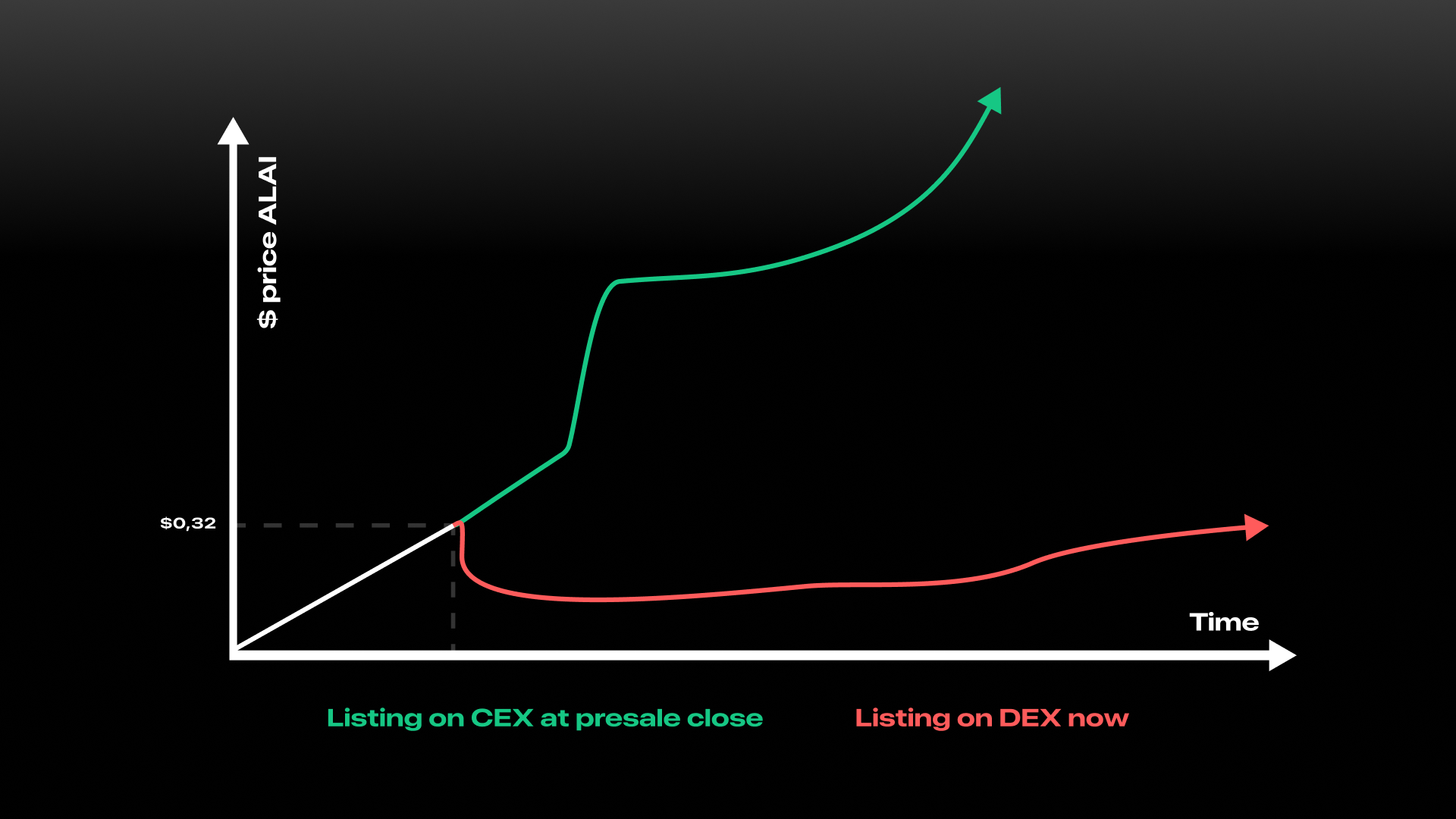

As part of our strategic vision, ALAI Network has made the decision to bypass the DEX listing phase entirely and focus on a direct launch on centralized exchanges (CEX) upon the completion of the presale. This decision reflects our commitment to enhancing project stability, maximizing dividends for participants, and ensuring long-term success.

Why the Focus on CEX?

The decision to forego a DEX listing is driven by the following considerations:

Minimizing Dividend Dilution

Allocating tokens for a DEX liquidity pool would have diluted participant dividends significantly. For example:

- Initially, 2,100,000 ALAI were allocated for DEX, which could have diluted existing dividend shares by 70%.

- This would have negatively impacted the returns for early supporters and hindered the overall growth of the project.

Maximizing Stability

A direct launch on CEX eliminates the risks associated with DEX liquidity pools, such as:

-

Impermanent loss

-

Fragmented trading volumes

This ensures greater stability for the AI trading pool and dividend payouts.

Updated Tokenomics

To strengthen the project’s foundation, we’ve restructured the token allocation to support a successful presale and direct CEX listing.

New Tokenomics:

-

Public Presale: 55% = 11,550,000 ALAI

-

Team: 10% = 2,100,000 ALAI

-

Development: 20% = 4,200,000 ALAI

-

Marketing: 5% = 1,050,000 ALAI

-

CEX: 10% = 2,100,000 ALAI

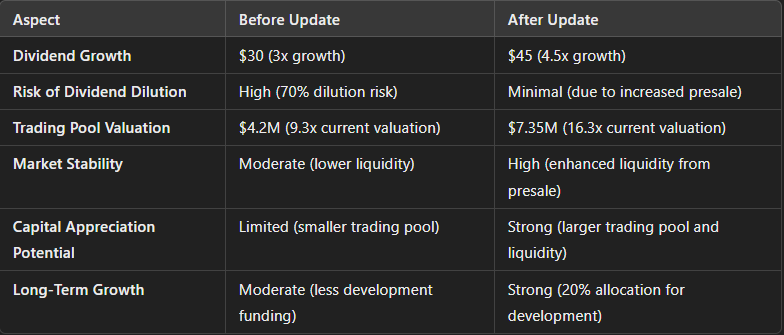

Benefits of New Strategies

Stronger Trading Pool

By reallocating tokens from the DEX liquidity pool to the presale, the project’s trading pool at launch will be significantly larger.

Projected Trading Pool Value at CEX Listing:

-

With previous tokenomics: $4.2M

-

With updated tokenomics: $7.35M (a ~16.3x increase from the current pool size of $452,000).

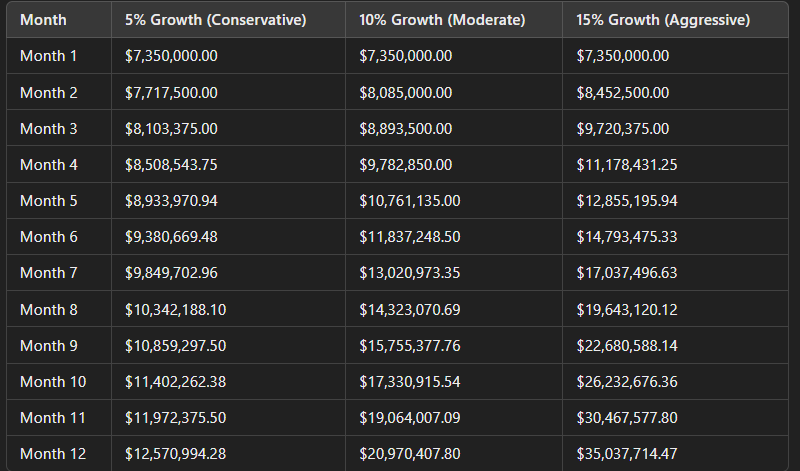

Compound Growth Table for $7.35M Trading Pool Over 12 Months

Below is a compound growth table showing three scenarios for the ALAI trading pool, starting with an initial value of $7.35M and growing monthly by 5%, 10%, and 15% over a 12-month period.

Higher Dividends for Participants

The larger trading pool ensures a substantial increase in dividend payouts.

Projected Dividend Increase:

-

Previous tokenomics: ~3x current dividends

-

Updated tokenomics: ~4.5x current dividends

Enhanced Market Trust

A direct launch on CEX demonstrates the project’s maturity and readiness for broader adoption, attracting institutional investors and larger trading volumes.