How ALAI Network Leverages K-means Clustering for Smarter AI-Powered Trading

ALAI Network is a unique platform that combines various machine learning models to optimize trading decisions. One of the key technologies in ALAI’s "zoo" of models is the K-means clustering algorithm, which plays a crucial role in market analysis, helping traders and investors maximize their returns. In this article, we will explore how ALAI Network uses K-means in combination with other models and how this synergy improves trading decision quality.

What is K-means and How Does It Work?

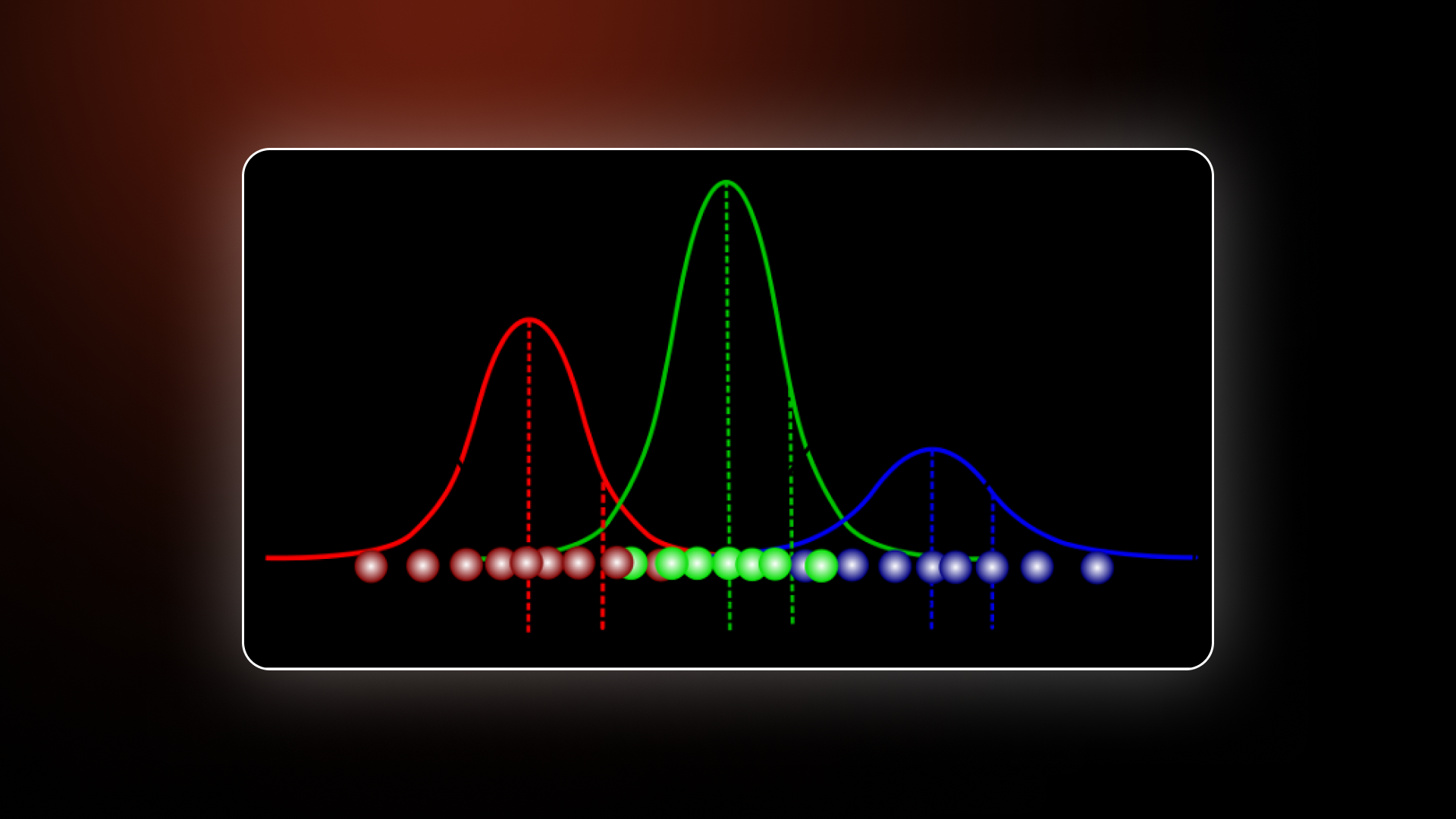

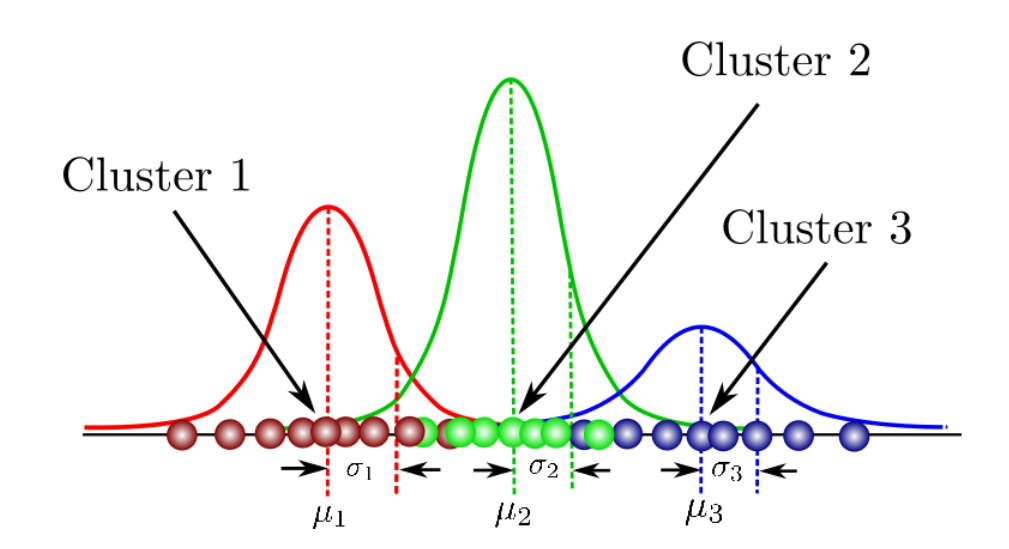

K-means is one of the most popular data clustering methods, used to divide a dataset into groups (or clusters) based on their similarities. The algorithm works as follows:

-

Randomly selects K centroids, which are points representing the centers of future clusters.

-

Assigns each data point (such as assets or time stamps) to a cluster based on its proximity to the centroids.

-

Recalculates the centroids for each cluster and reassigns data points until the cluster centers stabilize.

This process helps group data with similar characteristics, making K-means a useful tool for market data analysis.

How Does ALAI Network Use K-means?

In ALAI Network, K-means clustering is applied to group assets, trades, and markets by certain characteristics. These may include:

-

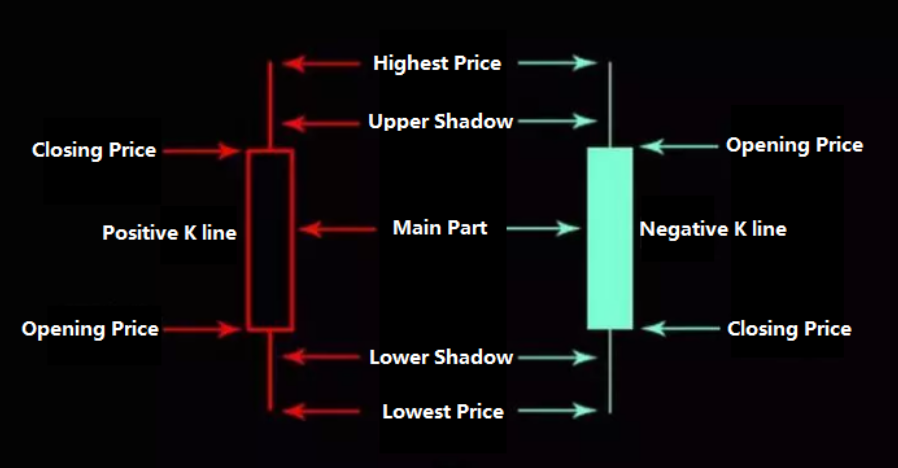

Asset volatility

-

Average trading volume

-

Correlation with other assets

-

Price reaction to market events

Once the data is grouped into clusters, the system can analyze the behavior of assets within each group and make trading decisions based on patterns observed in the cluster. For example, if a cluster shows high correlations between assets, the system can predict that changes in one asset will affect others in the group.

K-means in Combination with Other Models

While K-means is effective for clustering data, its potential is greatly enhanced when used in tandem with other models. In ALAI Network, K-means interacts with other models to improve predictions and decision-making.

Benefits of Using K-means in ALAI Network

-

Market Segmentation: K-means helps divide markets and assets into groups with similar characteristics, allowing the system to analyze their behavior more accurately and make better-informed trading decisions.

-

Scalability: This algorithm can handle large volumes of data and adapt easily to market changes, making it ideal for dynamic crypto markets.

-

Integration with Other Models: K-means works alongside forecasting models, sentiment analysis, and decision-making systems, providing a more complete and precise understanding of market conditions.

-

Resilience to Volatility: By clustering assets based on volatility, ALAI Network can develop more effective risk management strategies and predict market downturns.

Conclusion

Using K-means in combination with other machine learning models allows ALAI Network to offer unique solutions for trading and risk management. The clustering of markets and assets makes trading strategies more adaptive and accurate, helping ALAI ecosystem participants earn stable dividends and increase their profits. The entire system operates at peak efficiency thanks to the interaction of various machine learning models like LSTM, Random Forest, and Autoencoder, giving traders a multi-layered approach to market analysis.