How ALAI Network Utilizes Twitter-RoBERTa Sentiment Analysis for Risk Management

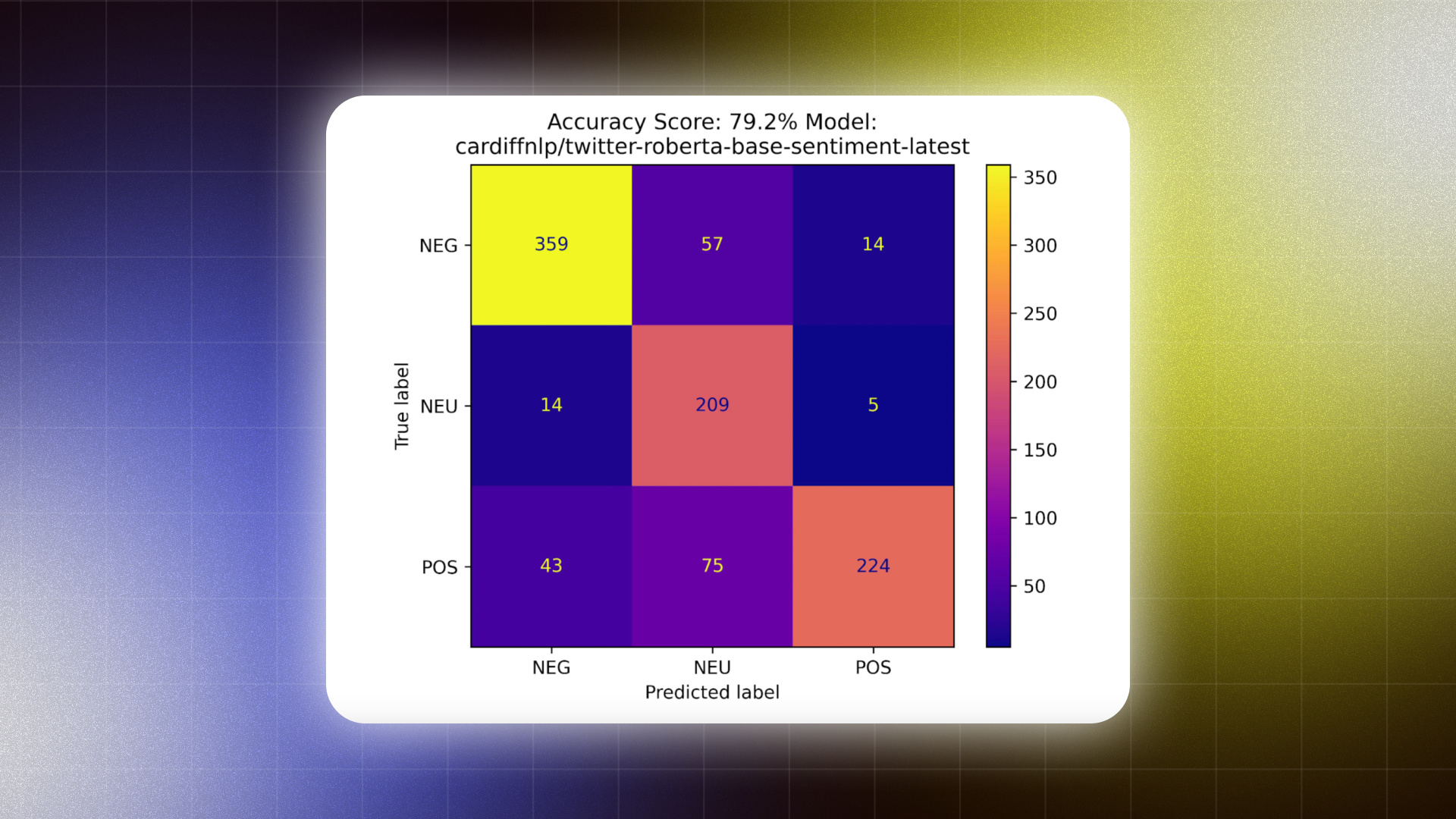

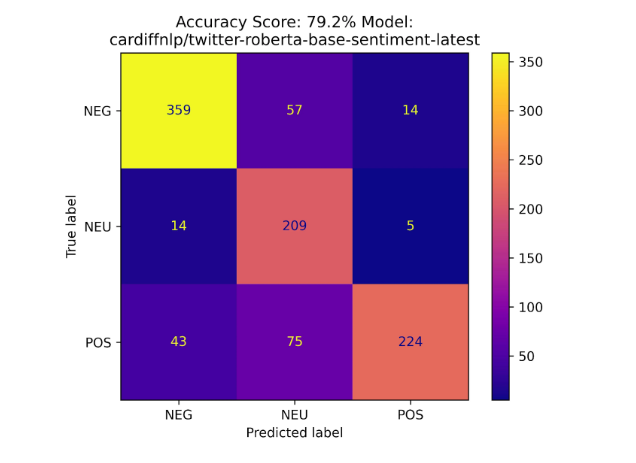

In the fast-paced world of cryptocurrency trading, making informed decisions often requires more than just technical analysis and price trends. Market sentiment—how investors and traders feel about certain assets—plays a critical role in influencing market behavior. ALAI Network, leveraging advanced artificial intelligence models, has integrated sentiment analysis into its AI-driven trading ecosystem. One of the key models ALAI Network employs is the Twitter-RoBERTa-base for Sentiment Analysis, a state-of-the-art model trained on over 124 million tweets (and counting, as it continuously learns and tracks real-time information from Twitter). This powerful tool helps ALAI evaluate market sentiment and dynamically adjust risk parameters.

What is the Twitter-RoBERTa Sentiment Model?

The Twitter-RoBERTa-base for Sentiment Analysis is a model specifically designed to process and interpret the emotions conveyed in tweets. Built upon the RoBERTa architecture, it has been fine-tuned using the TweetEval benchmark, making it highly effective at understanding the sentiment behind text data—positive, negative, or neutral.

Since social media platforms like Twitter are hotspots for real-time discussions about cryptocurrency, this model provides an invaluable edge in assessing market sentiment, identifying emerging trends, and recognizing potential risks or opportunities. By analyzing millions of tweets daily, the model gauges how the broader community feels about particular cryptocurrencies or market events.

How ALAI Network Uses Sentiment Analysis

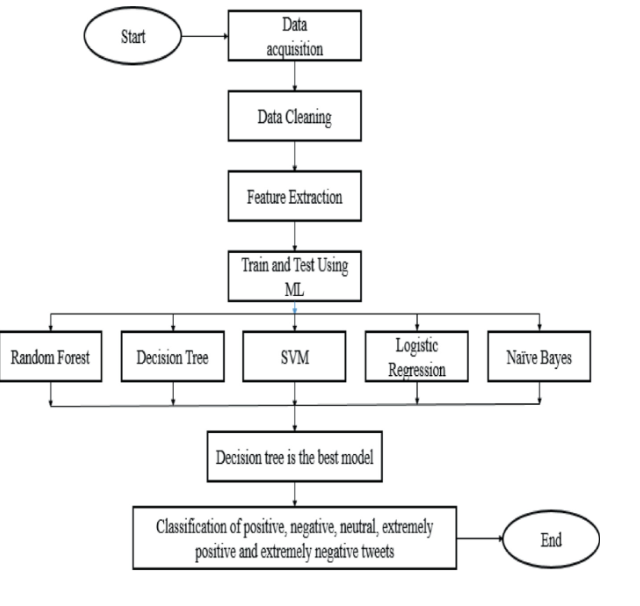

At ALAI Network, sentiment analysis is integrated into a multi-layered AI system, which includes over 120 models, each designed for a specific aspect of trading—whether it's time series forecasting, trend recognition, or risk management. Here’s how the sentiment model plays a crucial role in enhancing ALAI Network's trading strategies:

1. Sentiment-Driven Risk Adjustments

One of the core ways ALAI Network utilizes the Twitter-RoBERTa model is for dynamic risk management. Alongside technical indicators like price trends, trading volumes, and volatility metrics, ALAI analyzes sentiment data to adjust its risk parameters.

-

Positive Sentiment: When the sentiment model detects a significant positive shift in market sentiment—whether toward a specific asset or the market in general—ALAI can increase its risk tolerance. This might mean taking more aggressive long positions or investing in high-momentum assets.

-

Negative Sentiment: Conversely, if sentiment turns negative, the AI system lowers its risk exposure. For example, it might recommend shifting investments to more stable assets or reducing the size of open positions to safeguard against market downturns.

-

Neutral Sentiment: In periods of indecisiveness, where sentiment is neutral, the model guides ALAI to maintain a balanced approach, neither overly aggressive nor overly defensive, while waiting for more distinct signals.

2. Analyzing Market Reactions to Events

Another significant advantage of the sentiment model is its ability to analyze real-time reactions to major market events. Cryptocurrency markets are highly reactive to news, regulatory updates, or even influential social media posts.

-

Market Sentiment Shift on Breaking News: If a piece of news about a regulatory crackdown or a major endorsement hits Twitter, the sentiment model can quickly assess the community’s reaction. Based on this analysis, ALAI Network’s AI may recommend selling certain assets or buying into undervalued ones before the broader market reacts.

-

Identifying FOMO (Fear of Missing Out) or FUD (Fear, Uncertainty, and Doubt): The sentiment model also helps identify spikes in FOMO or FUD. If a sudden surge in positive sentiment occurs, likely triggered by hype, ALAI may choose to exploit short-term opportunities. If the model detects rising FUD, it can help ALAI avoid major losses by steering clear of overhyped assets or market bubbles.

3. Refining Trading Strategies

By using the sentiment data processed by the Twitter-RoBERTa model, ALAI Network enhances its overall trading strategy. This creates a more comprehensive approach where market behavior is analyzed through both quantitative and qualitative lenses. Some of the key ways sentiment data is used include:

-

Sentiment as a Complementary Signal: Instead of relying solely on price movements and volumes, ALAI incorporates sentiment as an additional indicator. For example, if the sentiment surrounding an asset is highly positive but technical indicators suggest overbought conditions, ALAI's AI system might opt for a more conservative approach, waiting for sentiment to stabilize.

-

Adapting to Market Cycles: Cryptocurrency markets tend to move in cycles of bullish and bearish periods. The Twitter-RoBERTa sentiment model helps ALAI recognize where we are in these cycles by gauging investor enthusiasm or fear. During bullish periods, positive sentiment may signal an optimal time to increase exposure, while during bearish periods, rising negative sentiment can signal a time to shift strategies or hedge positions.

Sentiment Analysis: A Critical Component of ALAI Network’s AI Ecosystem

The integration of the Twitter-RoBERTa model is just one part of ALAI Network's extensive AI infrastructure, which includes more than 120 machine learning models. Each model is designed to tackle a specific challenge in trading, from forecasting future price movements to assessing overall market risk. The sentiment analysis model, however, plays a unique role in that it allows ALAI Network to capture the human element of trading—how investors feel about the market.

By combining sentiment analysis with traditional technical indicators, ALAI Network creates a more resilient and adaptive trading system. The ability to dynamically adjust risk parameters based on real-time market sentiment offers a significant advantage, particularly in the volatile and sentiment-driven world of cryptocurrency trading.

Conclusion

At ALAI Network, the use of advanced AI models like Twitter-RoBERTa for Sentiment Analysis represents the future of AI-driven trading strategies. By leveraging both quantitative market data and qualitative sentiment analysis, ALAI provides a more robust risk management system, helping traders make more informed decisions and stay ahead in the fast-moving crypto market. Whether it's adjusting risk parameters based on shifting market sentiment or refining trading strategies to avoid the dangers of market hype, ALAI Network ensures that its users are always one step ahead.

If you're ready to explore the future of AI-powered trading, join us at ALAI Network, where cutting-edge technology meets profitability!