Optimization of Trading Data in ALAI Network

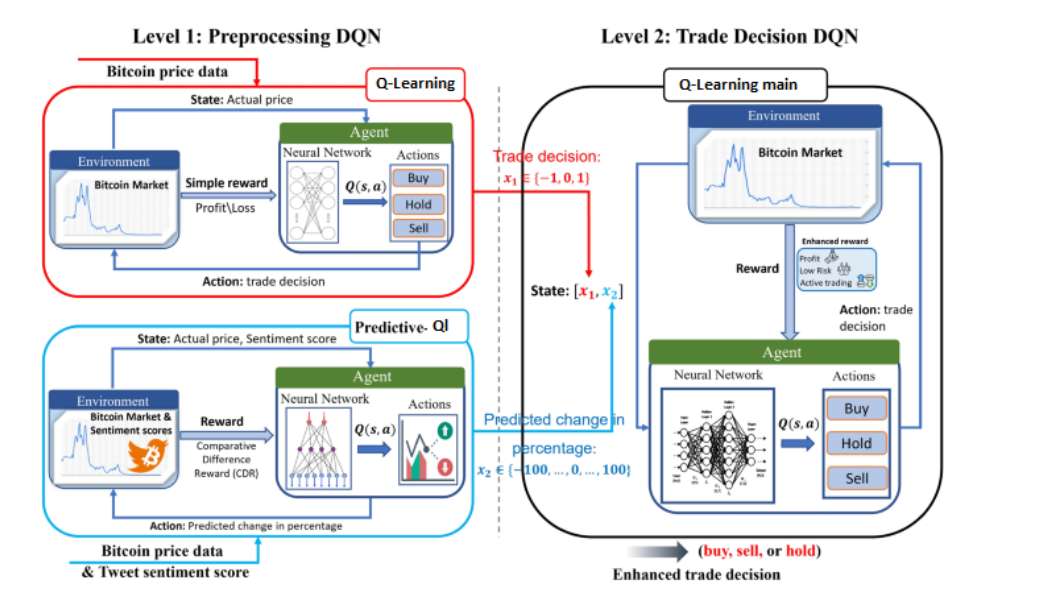

ALAI Network employs an ensemble approach, where Q-Learning models interact with other algorithms, creating synergy and enhancing the efficiency of trading strategies. This means the system does not rely on a single model but utilizes a diversity of methods for analysis and decision-making. Such an approach improves the overall quality of predictions, minimizing the impact of potential errors from any individual model.

Assessing Market Uncertainty

Q-Learning is an algorithm that learns to select optimal actions to maximize profits during trading. It is an off-policy method, meaning it doesn't need to follow the current strategy, which makes it particularly useful in the ever-changing financial markets.

Key Elements of Q-Learning:

-

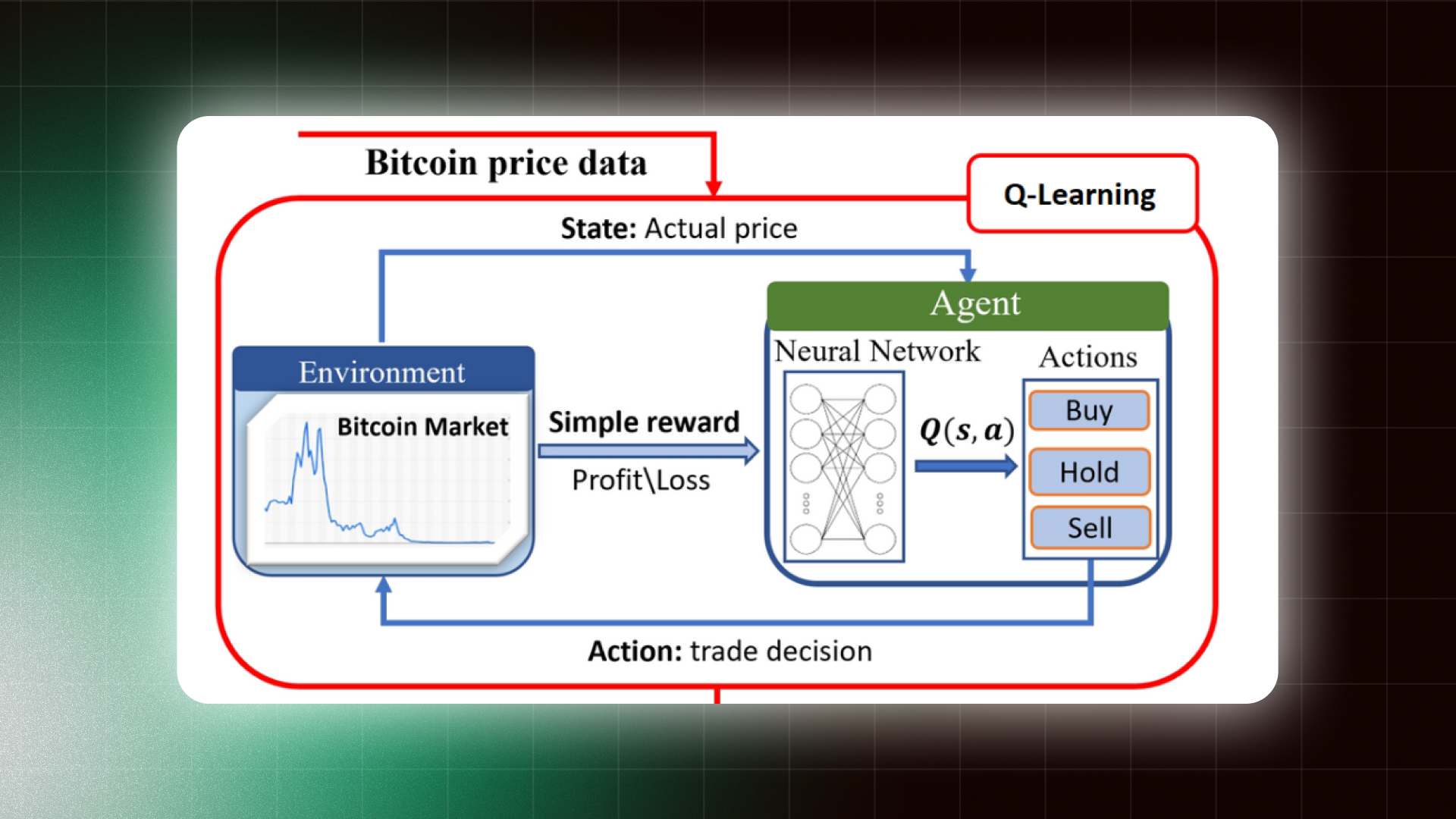

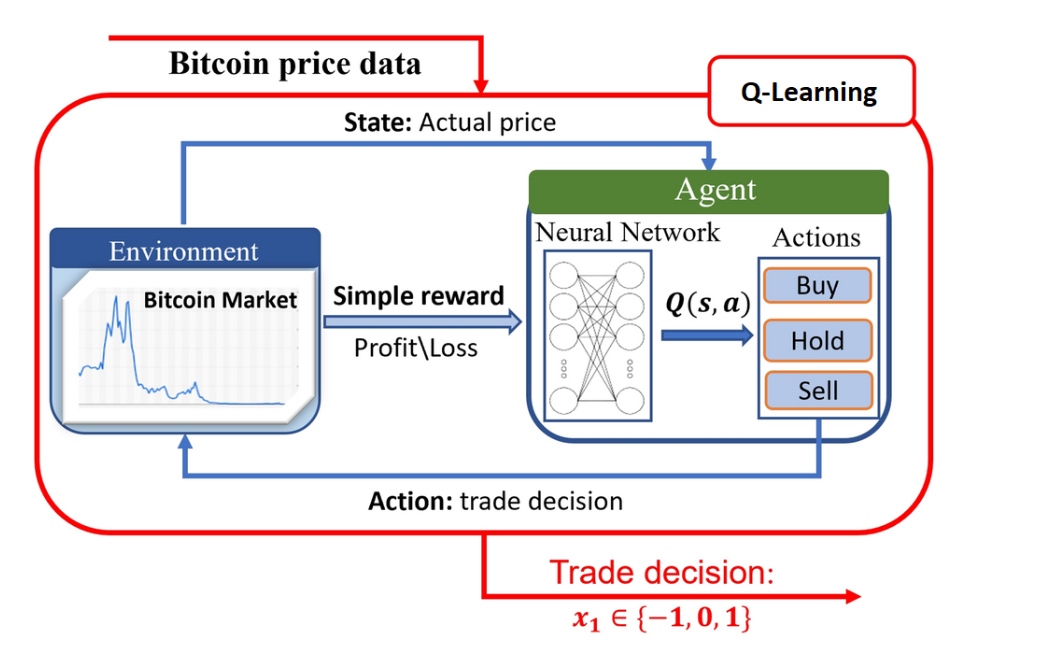

Agent: In ALAI Network, the agent is the trading system making decisions (buy, sell, or hold assets).

-

Environment: The cryptocurrency market, which constantly fluctuates.

-

States (S): Current market conditions defined by indicators like asset prices, trading volumes, and volatility.

-

Actions (A): Decisions that the system can take (buy, sell, or hold).

-

Rewards (R): Profit or loss received from each action.

-

Q-Function: The model updates the matrix of action values for each state based on the outcome, allowing the system to refine its strategy over time.

Q-Learning models assist ALAI Network in measuring the level of uncertainty in financial markets. In conditions of high volatility, these models help determine when to avoid risky trades. For example, if the market demonstrates a high level of uncertainty, ALAI Network may decide to reduce positions in less stable assets. Thus, the system adapts to current conditions, protecting traders' capital.

Data-Driven Signals

By utilizing Q-Learning models, ALAI Network analyzes historical price data, identifying significant patterns and trading signals. This enables predictions of price changes and allows for real-time adaptation of trading strategies. As a result, traders can more accurately determine entry and exit points in the market, ultimately leading to increased trade profitability.

Optimizing Trading Strategies

Q-Learning models also facilitate the automation of trading decisions. They help ALAI Network evaluate the effectiveness of various trading strategies by analyzing current market conditions and previous trading results. Based on this information, the system can automatically adjust its approaches, allowing traders to stay informed of changes and make more informed decisions.

Enhancing Algorithmic Trading

In algorithmic trading, Q-Learning plays a crucial role by providing information on when to open or close positions. This enables ALAI Network to optimize its trading decisions, improving their accuracy and reliability. Each algorithm in the system can utilize data from Q-Learning models to enhance its predictions and minimize errors.

Model Testing and Validation

Before implementing models into trading strategies, ALAI Network conducts thorough testing and validation. All models, including Q-Learning ones, are evaluated on historical data to ensure their effectiveness and reliability. This approach provides confidence that each model is ready to operate in real markets and can successfully handle various scenarios.

Conclusion

The use of Q-Learning models in ALAI Network is a key element in achieving high trading results. The ability of these models to assess uncertainty and integrate with other algorithms allows ALAI Network to develop adaptive, resilient, and effective trading strategies that optimize profits and minimize risks. In a world where changes happen instantly, such technology integration becomes essential for successful trading.