What is Staking and How Does It Work?

In the rapidly evolving world of cryptocurrency, staking has become a popular way for token holders to earn passive income. Staking allows users to lock up their assets in a blockchain network to support its operations, and in return, they earn rewards. But what exactly is staking, and how does it work, especially in the case of ALAI staking in USDT?

What is Staking?

Staking is the process of locking up a cryptocurrency in a wallet to support the security and operations of a blockchain network. This is most commonly seen in Proof-of-Stake (PoS) or Delegated Proof-of-Stake (DPoS) blockchain models, where instead of mining like in Bitcoin's Proof-of-Work (PoW) model, participants validate transactions and secure the network by staking their tokens.

In return for locking up their tokens, stakers earn rewards, which are typically paid out in the cryptocurrency they staked or in another form, depending on the platform.

Key benefits of staking include:

-

Passive Income: Stakers earn regular rewards for locking up their tokens, allowing them to generate income without needing to trade or sell their assets.

-

Network Participation: By staking, you actively contribute to the security and functionality of the blockchain, making it a vital process for decentralized networks.

-

Lower Energy Costs: Compared to PoW mining, staking is much more energy-efficient and environmentally friendly.

How Does Staking Work on ALAI Network?

The ALAI Network offers a unique staking opportunity by allowing users to stake USDT (Tether) --- a stablecoin pegged to the US dollar. Unlike many other platforms that require users to stake their native tokens, ALAI staking provides the advantage of earning rewards in a stable, low-volatility asset.

ALAI Staking in USDT: How It Works

-

Access to Staking: To participate in staking on ALAI Network, users need to hold a certain amount of $ALAI tokens to unlock the staking feature. However, the staking itself is done with USDT, providing more stability and predictability in earnings.

-

Staking Process: Once you've unlocked the staking feature with $ALAI, you can stake your USDT for a specified period. The longer you stake, the higher the potential rewards.

-

Reward Distribution: Stakers receive their rewards in USDT, offering a more stable form of passive income compared to platforms that reward in volatile cryptocurrencies. This means you can earn rewards without the risk of losing value due to price fluctuations in the reward token.

Why is USDT Staking Beneficial?

Staking with USDT provides several advantages over staking volatile cryptocurrencies:

-

Stability: USDT is a stablecoin, meaning its value is pegged to the US dollar. This makes it a safer option for users who want to earn rewards without being exposed to the risks of price volatility that are common with other cryptocurrencies.

-

Predictable Income: Since USDT maintains a stable value, your rewards remain consistent, allowing you to more accurately predict your earnings over time.

-

Liquidity: USDT is one of the most widely used stablecoins, making it highly liquid and easy to exchange for other assets whenever you choose to exit the staking program.

How to Start Staking on ALAI Network?

Staking on ALAI Network is designed to be user-friendly. Here's how you can get started:

-

Hold $ALAI Tokens: First, acquire the required amount of $ALAI tokens to unlock the staking feature.

-

Stake USDT: Once you've unlocked the staking functionality, deposit your USDT into the staking pool for the selected duration. Different staking tiers offer various rewards depending on the amount staked and the time commitment.

-

Earn Rewards: Sit back and earn rewards in USDT. The longer you stake, the higher your rewards will be.

ALAI Staking Tiers

The ALAI Network offers a tier-based staking system that allows you to earn higher rewards based on the amount of USDT staked and the staking period:

-

Tier 1: Stake a minimum amount of USDT for a short period and earn modest rewards.

-

Tier 2 and higher: Commit more USDT for longer periods to unlock higher reward percentages.

This tier-based system offers flexibility for both small-scale investors and those who are ready to stake larger amounts for longer durations.

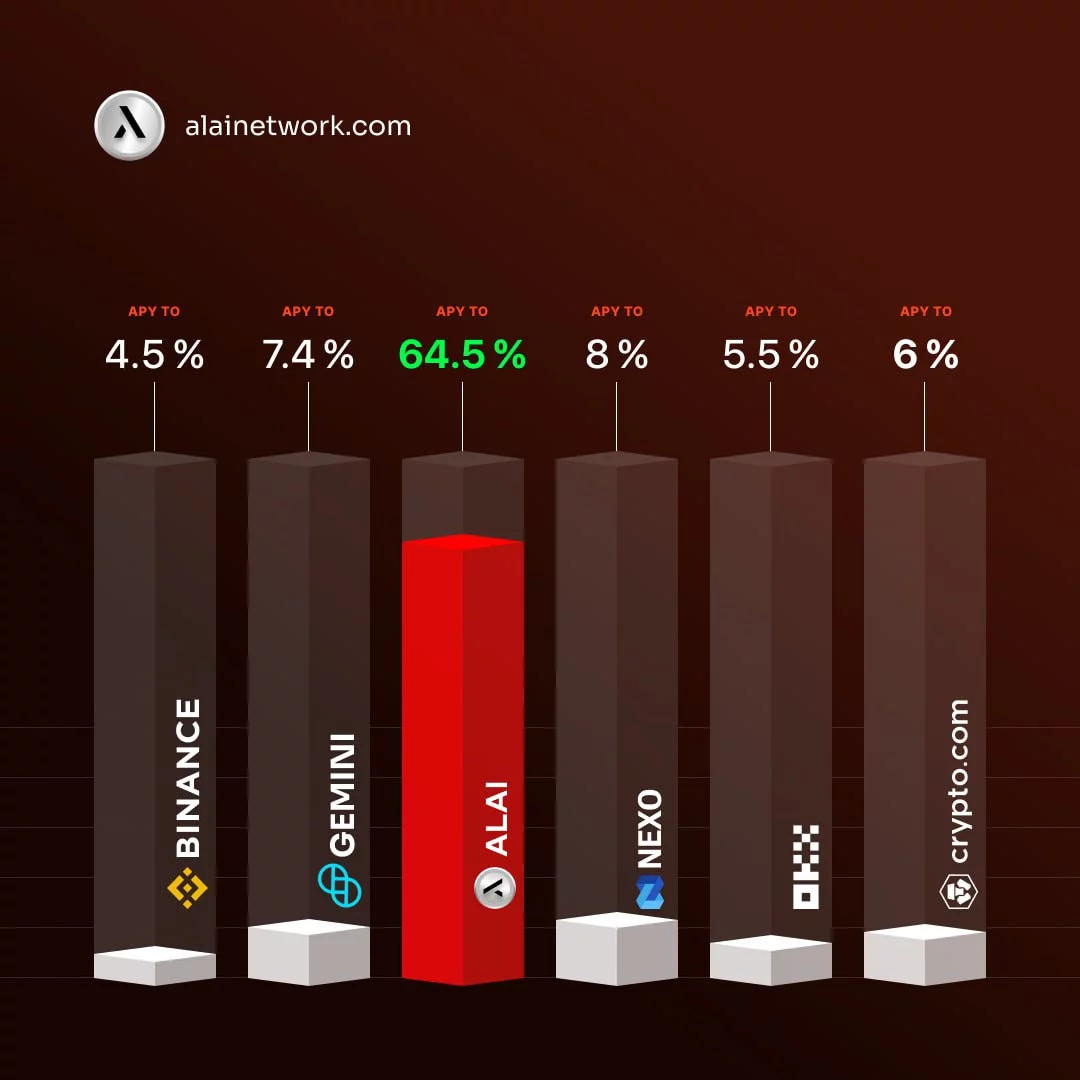

Why Staking on ALAI is Different?

-

Staking in USDT: Unlike many other platforms that require staking in volatile tokens, ALAI Network allows staking in a stable asset like USDT, providing greater financial security.

-

Tier-Based System: The flexible tiers mean you can choose a staking plan that aligns with your investment strategy, whether short-term or long-term.

-

Passive Income in USDT: With rewards paid in a stablecoin, you're less exposed to the volatility that often affects other staking platforms.

Conclusion

Staking is a great way to earn passive income while contributing to the security and growth of a blockchain network. On ALAI Network, staking is made even more attractive by allowing users to stake USDT, a stable and reliable asset. With the flexibility of the tier-based system and the added stability of USDT rewards, ALAI staking offers a unique and secure way to grow your assets.

If you're looking for a secure and stable way to earn from your cryptocurrency holdings, ALAI staking in USDT is a perfect option. Join the ALAI Network today and start staking for consistent, reliable rewards!