Cross-Modal Integration: How It Works in ALAI Network

In the fast-paced world of trading, relying on a single source of information is no longer sufficient. Markets are shaped by a multitude of factors: textual data, charts, images, sound, and more. Cross-modal integration enables ALAI Network's artificial intelligence (AI) to combine these diverse data sources, creating more accurate predictions and making optimal trading decisions. Let’s explore how cross-modal integration works in ALAI Network and why it is so crucial for the trading ecosystem.

What Is Cross-Modal Integration?

Cross-modal integration is the process of merging data from different formats (text, images, charts, time series, audio) to create a unified and comprehensive understanding of market activity. Instead of analyzing information in isolation, AI studies the connections between various data types, uncovering hidden patterns and trends. For example:

-

Text data (news, comments, reports) can provide insights into market sentiment.

-

Price and volume charts show how an asset's value evolves over time.

-

Blockchain graph data reveals interactions among large players.

By combining these sources, the ALAI Network system gains access to much deeper analytics.

How Does It Work in ALAI Network?

Text and News Analysis

AI processes thousands of text-based inputs, including news articles, social media, and analytical reports.

Chart and Visual Data Processing

Computer vision algorithms (e.g., CNNs) analyze price charts and visual patterns.

Blockchain Graph Data

Graph neural networks (GNNs) monitor large transactions and connections between wallets.

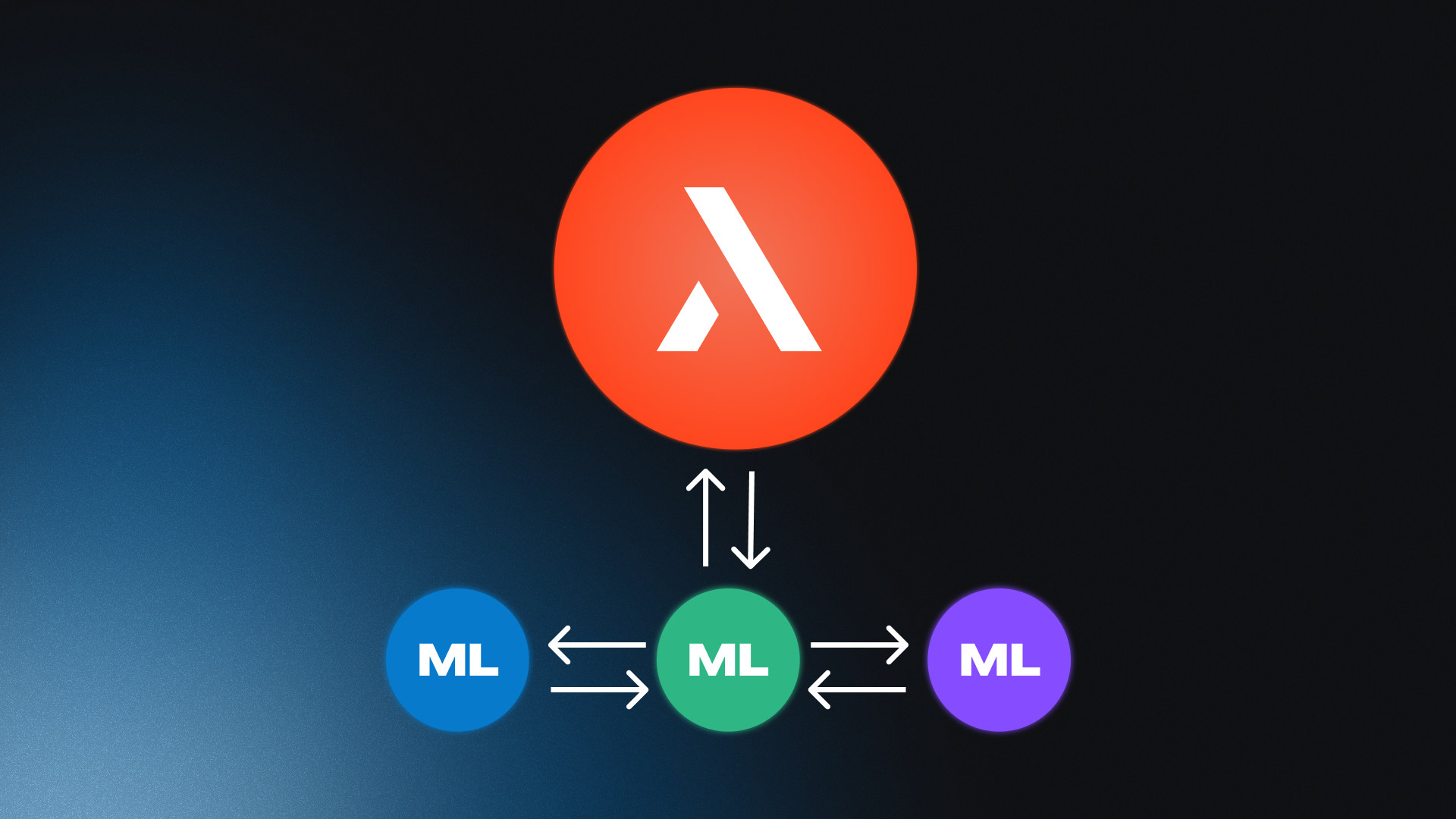

Data Combination

All collected data is processed through neural network layers to identify correlations between textual events, charts, and market participant behavior.

Why Is This Important for Trading?

-

Enhanced Prediction Accuracy: Combining multiple data types compensates for gaps that might occur when analyzing a single source.

-

Early Trend Detection: Cross-modal integration uncovers hidden market signals before competitors do.

-

Risk Reduction: By considering diverse data sources, algorithms reduce the likelihood of errors caused by market noise.

-

Dynamic Model Learning: Continuous analysis of new data improves model performance over time.

How Does This Benefit ALAI Network Participants?

-

Participants receive stable dividends thanks to the precise performance of trading AI.

-

The growing trading pool size and trading efficiency contribute to higher payouts.

-

In the long term, cross-modal integration strengthens system resilience, providing a competitive advantage for the ALAI community.

Conclusion

Cross-modal integration is an innovative approach that ensures ALAI Network’s superiority in the trading space, empowering its AI to unlock the full potential of diverse data sources. Join ALAI Network and experience how technology works for you!