How Does the ALAI Network Trading Pool Work?

The ALAI Network trading pool is the foundation of the project’s profitability and stability, managed by artificial intelligence (AI). It offers participants the opportunity to receive dividends through algorithmic trading in financial markets. Let’s break down how the trading pool is formed, why its growth is essential, and how it impacts dividend payouts.

How the Trading Pool Is Formed

When you purchase ALAI tokens, your funds are directed into the trading pool, becoming part of the capital managed by AI. Your share in the pool depends on the number of tokens you hold: the more tokens you have, the larger your share of the profits.

The pool’s operation is straightforward: each investment in ALAI tokens increases the overall volume of the trading pool, which is used for trading. This creates a direct link between participants and the system’s financial success.

Why Is the Growth of the Trading Pool Important?

The growth of the trading pool is crucial for several reasons:

Increased Payouts for Participants

ALAI Network allocates 50% of its trading profits as monthly dividends to token holders. The larger the pool, the higher the trading potential and, consequently, the dividends.

Building a Resilient System

A larger pool helps reduce market risks through diversification and enhances AI algorithms. Pool stability ensures the long-term sustainability of the project.

Future Perspective: Profit Reinvestment

Once the trading pool reaches its optimal size, ALAI Network will begin automatically reinvesting 50% of its trading profits back into the pool. This will create a compounding effect, driving the pool’s continuous growth and ensuring stable increases in payouts for participants.

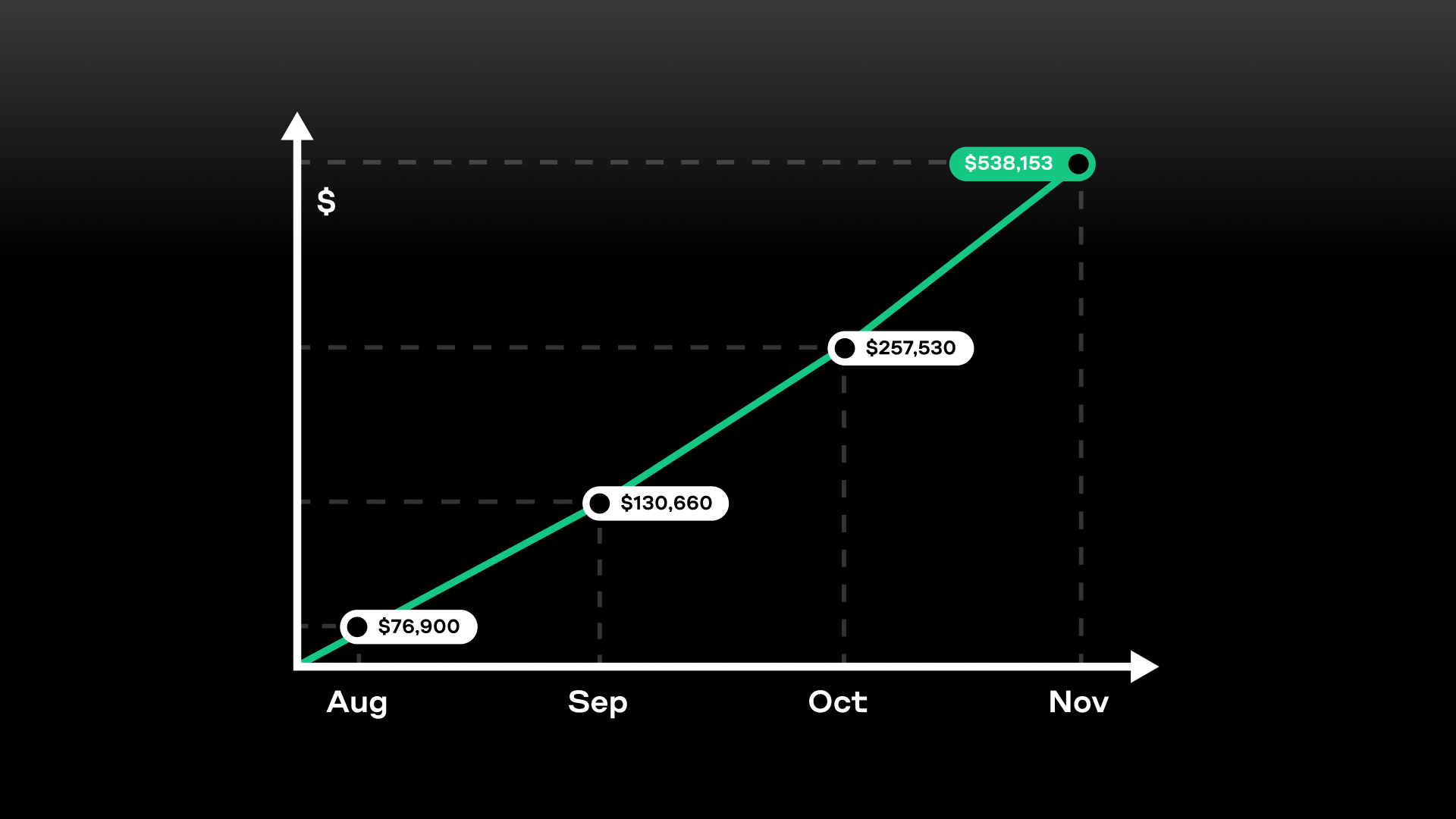

Trading Pool Dynamics: How It Has Grown

Over the past few months, the trading pool’s growth has been remarkable. Here are the figures:

-

August: $76,900

-

September: $130,660

-

October: $257,530

-

November: $538,153

-

December 5: $647,665

In just four months, the pool’s volume has grown eightfold, showcasing the high level of participant trust and the efficiency of AI-driven management.

Impact of Pool Growth on Dividends

The growth of the trading pool directly affects the size of the dividends distributed to ALAI token holders. Let’s review the monthly dividend payouts:

-

August: $0.004156 USDT (per ALAI token)

-

September: $0.00457884 USDT (per ALAI token)

-

October: $0.00591571 USDT (per ALAI token)

-

November: $0.01064 USDT (per ALAI token)

In November, the dividends more than doubled compared to August, underscoring the effectiveness of the trading strategy and the potential for reinvestment in the future.

Conclusion

The ALAI Network trading pool is the core of the ecosystem, providing stable growth and returns for participants. By purchasing ALAI tokens, you not only increase your share in the pool but also contribute to its expansion. In the future, once the pool reaches its optimal size, the introduction of a profit reinvestment mechanism will create a powerful long-term effect, strengthening the system and increasing payouts for all participants.

Join ALAI Network and become part of an advanced system where your investment works for you!